When the World Doesn’t Work the Way You Think It Should

It was wrongly assumed that the 21st century uranium market would prove oligopolistic, vertical and risk-averse while immature and horizontal with shared risk when mature.

Instead, the uranium market has aged into one wherein a thin residual spot market is maintained to merely equilibrate shocks; a market characterized by a late-successional pricing scheme wherein spot transactions grow thinner and thinner, taking de facto back seats to vertical, risk-averse, long-term contracting, wherein primary shocks reside with the seller, who counter with variable producer prices.

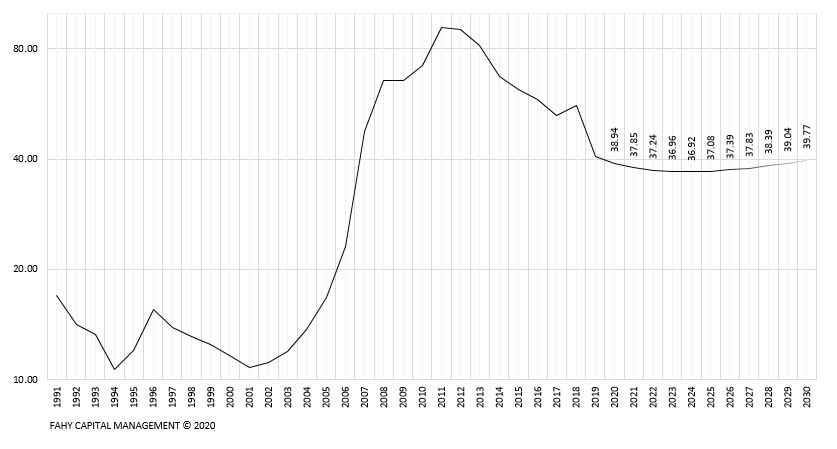

Today’s producer prices stem from oligopolistic cartelization and these cartel prices positively diverge from spot prices to the extent that a two-price system becomes untenable (today). This has the effect of driving down producer prices to a bit above to slightly below cost, at which point insurance against unexpected income variances at the level of the producer diminishes, followed by an abandonment of cartel pricing (tomorrow) and a return to an interim spot regime, completing the cycle.

Uranium is one stage away from completing the aforementioned cycle.

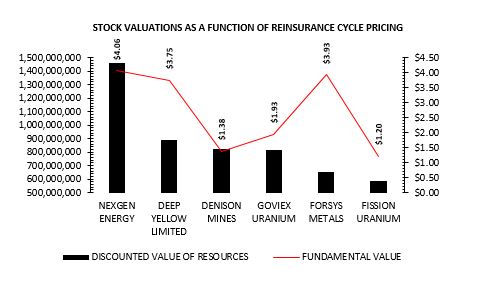

This bodes well for primary uranium producers, though the why of it is little discussed and remains poorly understood by analysts. Buyers, unaccustomed to supply shocks, have been unwilling to pay an implicit security premium to primary producers, favoring gray and state-owned secondary markets, and as a consequence, seller profits have become vulnerable. In other words, buyers no longer have deep insurance against shocks originating with the seller through incentive spot pricing, which in turn heals seller income variances. This necessitates a cyclical reinsurance program through spot appreciation and an implicit reinstatement of long-term contract security premiums.

We suggest a reinsurance program through spot appreciation will become effective at an average price of ~$38/lb. U308, which will represent the intersection of normalized long-term (chart) and cash reinsurance prices.